Calculating for Basic Pay

In the Paycheck HRIS and Payroll System, Basic Pay is calculated in 2 ways, depending the type of salary the employee has:

Daily-Rate Employees

The Basic Pay (which is the OR Pay in the Paysheet Form – OR Pay also stands for Ordinary Pay) is the Hourly Rate of the employee multiplied by the # of Regular Hours worked (or OR Hrs in the system):

OR Pay = OR Hrs x Hourly Rate

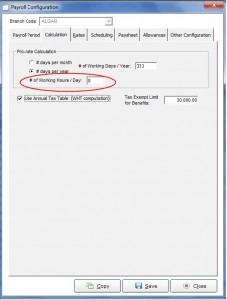

To get the Hourly Rate of the Employee, divide the Daily Rate by the # of working hours per day. The # of working hours per day is set in the Calculation Tab of the Branch Payroll Configuration Form:

Monthly-Rate Employees

For Monthly-Rate employees, the Basic Pay is the monthly rate divided by the # of pay periods per month, minus deductions for absences, tardiness and undertime. For absences with corresponding approved leave with pay, the Leave Pay will offset the deduction for the absence.

To compute for the deduction for absences, tardiness and undertime, multiply the hourly rate of the employee against the # of hours for absences, late and undertime.

There are two ways to get the hourly rate of a monthly-rate employee:

- Monthly Rate x 12 / # Working Days per Year / # Working Hours per Day

- Monthly Rate / # Working Days per Month / # Working Hours per Day

This depends on the Pro-Rate Calculation Setup which is set in the Calculation Tab of the Branch Payroll Configuration Form:

What about work done on Holidays?

For work rendered on Holidays, there is an option if you want the first 100% of the employee’s pay to show under the Basic Pay column.

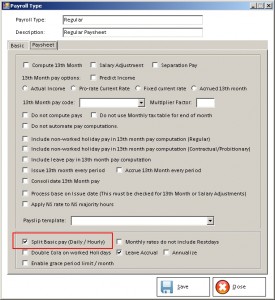

On the Payroll Type setup, there is an option to split the Basic Pay:

If this is enabled, that means the first 100% of an employee’s pay for Holiday work will appear under the Basic Pay column, while only the additional premium pay will appear under the Holiday Pay columns.

If this is not enabled, the entire pay for the work rendered on Holidays will appear under the Holiday Pay columns.